U.S. student loan debt has reached 1.3 trillion dollars — and counting. If you were able to stack (in one dollar bills) the amount of debt our countries’ students have incurred, the mass would tower over 88,000 miles high.

We’re not here to break the news that our country is facing a student loan crisis, however. That, by now, is common knowledge.

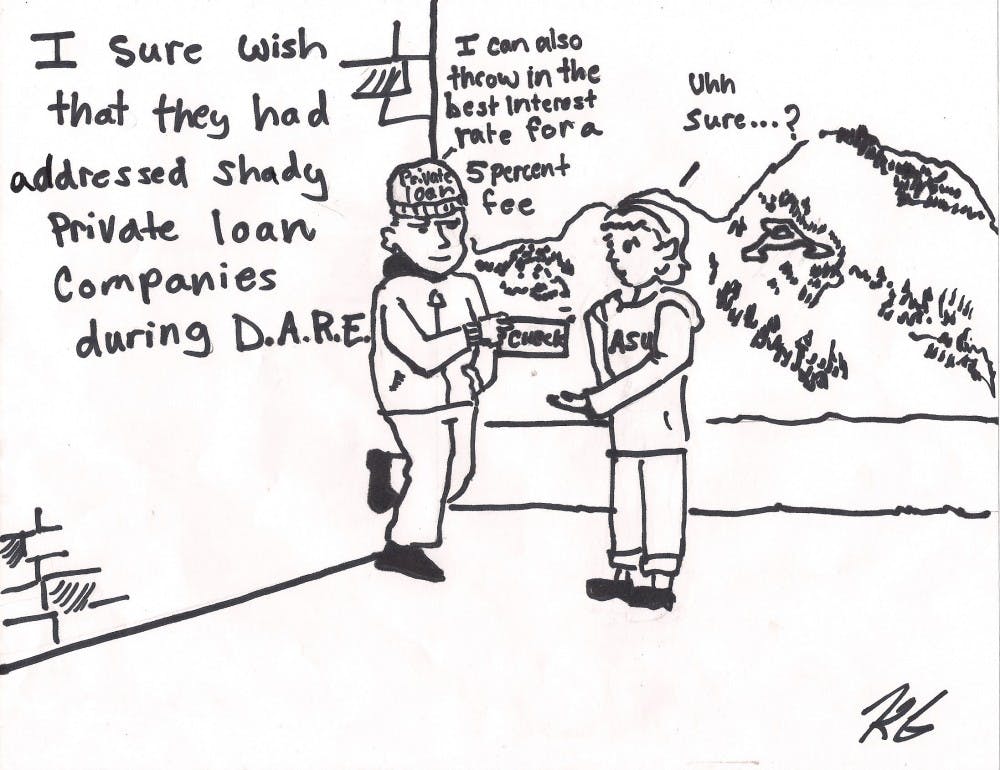

We purport that beyond the flawed financial system of higher education, there is an underlying education problem facing students who require aid to attend college.

As students ourselves, we at The State Press have both seen and felt the strain of failing to understand credit, taking out a high interest loan or not realizing that you accrue interest while pursuing your undergrad.

Just as not everyone has the means to pay the costs of college outright, not everyone is financially literate when they begin school either. Quite often those with the greatest financial need will also require the most educating.

Yes, it falls on students to know what they are getting themselves into when they take out a loan. If, however, a parent, a teacher or a guidance counselor never walked you through “Financial Literacy 101” then where is there to start? Students are currently being placed in the conundrum of being required to know what they don’t know — a nearly impossible task.

The student loan crisis is a pervasive problem in which culpability has to be attributed to all of the players in the game. University costs, student financial literacy, lending institutions, the economy as a whole — the list goes on — and while there is no easy solution to student loan debt, the current climate is indicative of problems that can be solved.

We are fortunate to attend one of the most affordable universities in the country, yet the average ASU student who took out loans graduated with $22,000 in student loan debt, according to a study by the Institute for College Access and Success.

The blame should not be placed on ASU for students’ lack of financial literacy, but as a University we stand in a unique position to address these issues. ASU already has information available to students, but there is still a clear divide between the ASU financial knowledge base and what students have gleaned from ASU's offerings.

ASU has an opportunity to act as a gatekeeper. If students enroll at ASU with a lapse in their financial literacy, especially as it pertains to loans, ASU has the ability to both provide pertinent information and ensure students' literacy.

Editors note: clarification has been added regarding the amount of student loan debt students graduate with.

Want to join the conversation? Send an email to opiniondesk.statepress@gmail.com.

Keep letters under 300 words and be sure to include your university affiliation. Anonymity will not be granted.

Like The State Press on Facebook and follow @statepress on Twitter.