ASU faculty and students are exploring the next steps toward easing the University’s financial burden in the wake of Arizona’s passing of Proposition 100.

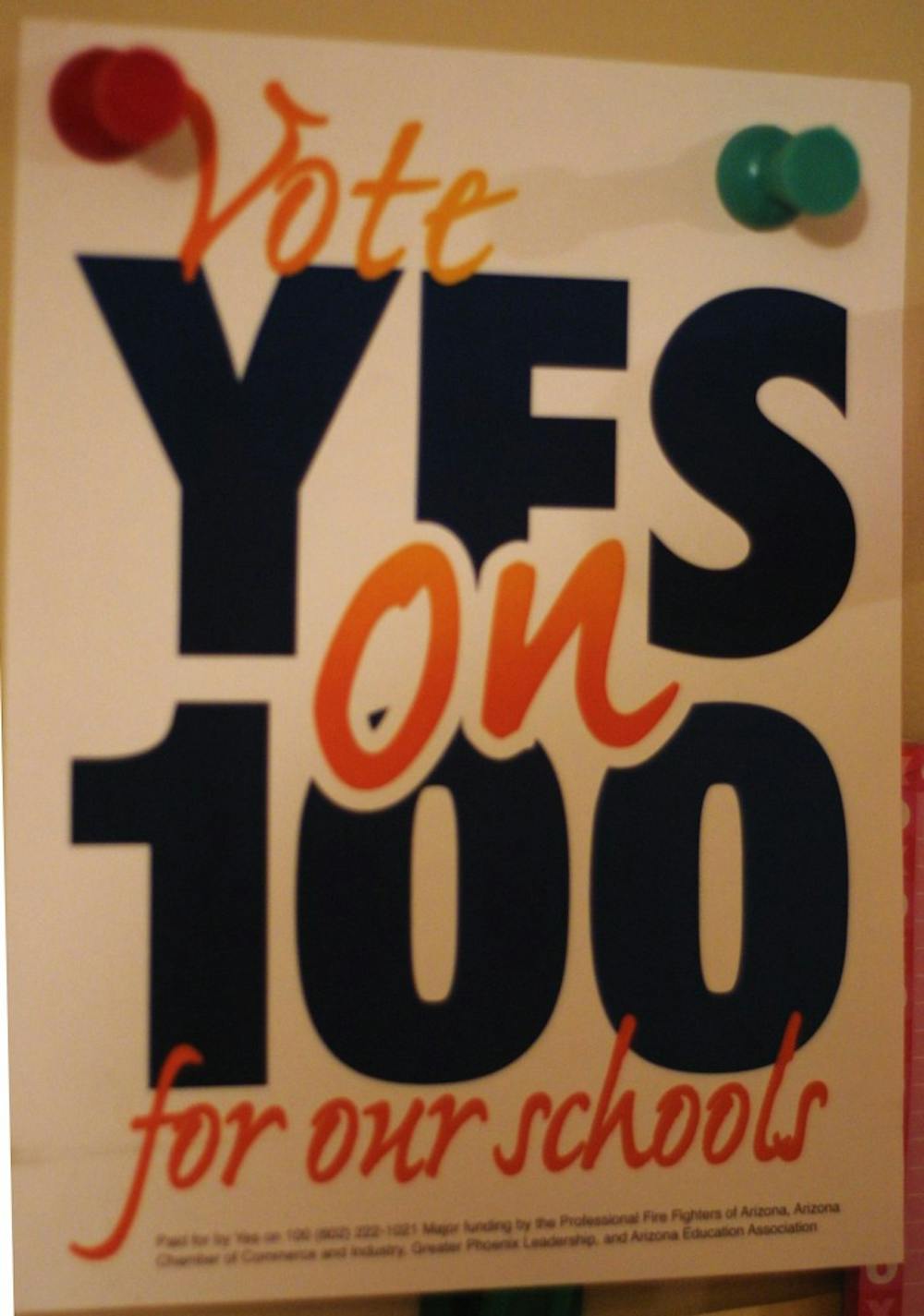

While the temporary 1-cent-per-dollar sales tax increase, which won the support of voters on May 18, will spare ASU, NAU and UA from receiving about $107 million in cuts, some officials believe this is the opportune time to examine how the schools are funded.

Kristin Borns, senior analyst for ASU’s Morrison Institute for Public Policy, said the three-year tax allows enough time for the state Legislature to look at its fiscal policy and figure out how to balance the structural deficit.

“We have consistently had expenditures exceeding revenues,” Borns said. “The state of Arizona funds everything predominantly on sales tax.”

Borns said 55 percent of the revenue from sales tax projected for fiscal year 2011 will go into the state’s general fund, of which 11 percent will go toward the universities, making it one of the biggest expenditures in the budget.

Robyn Nebrich, the interim executive director of the Arizona Students’ Association, said many of her colleagues consider Proposition 100 a “Band-Aid for the crisis” Arizona is facing.

ASA is a lobbying organization funded by a $2-per-semester fee paid by the students of ASU, UA and NAU. The association campaigned for the passage of Proposition 100 throughout the spring semester.

Nebrich said true reform for how education is funded can only come about if the students are involved.

“You have to get all the key stakeholders together — that of course includes the students — and see how they’d come up with a solution,” Nebrich said. “Legislators, universities and the [Arizona] Board of Regents all might have different solutions. If it’s just one person coming up with a solution, it might not fit for everyone.”

Undergraduate Student Government President Jacob Goulding said his administration is working toward establishing a presence for ASU’s student body at the Capitol.

“We’re looking at having a voice at the state Legislature at all times,” Goulding said, “and making sure that these newly elected officials understand that higher education is a priority to the state, local and federal governments.”

ASA will be working toward educating students about the upcoming election and getting them registered to vote. In 2008, the association registered about 10,000 students to vote, a number the ASA plans to match for the 2010 elections.

Nebrich said students need to know who they are voting for if they want to affect the decisions being made in the Legislature.

“A lot of people say that they’re for education, but you have to look at how they’re voting and not just campaign rhetoric,” Nebrich said.

To help students, ASA is working on creating a “score card” that will allow students to keep track of how legislators are voting on the issues and measure who is actually representing them at the Capitol, Nebrich said.

The issues with fiscal policy affect more than the universities but also state programs, Borns said, and the state needs to examine where its funding comes from in order to fix the structural deficit.

“There have been a number of commissions throughout the decade that have made some suggestions about how to have a balanced budget,” Borns said. “We could tax services or have a state-wide property tax.”

Borns said the passing of Proposition 100 is the perfect opportunity for the Legislature to reevaluate its fiscal processes.

“The next step is recognizing that we have one last chance to look at a balanced fiscal policy,” Borns said. “[The Legislature should] take advantage of all the work commissioned up to this point and look at a balanced fiscal structure.”

ASU College Republicans President Tyler Bowyer said he agrees there is an issue with how the Legislature spends the money on education, but not how it is funded.

“One of the beautiful parts about our state is we have been able to attract a number of businesses … from California and other high tax states because of our low taxes,” Bowyer said. “I don’t think there’s a problem with having low taxes. If you ask me, we need to lower taxes to create as much jobs in our state as possible.”

Reach the reporter at joseph.schmidt@asu.edu