The average Arizona graduate's student debt is below the national average five years after graduation, according to a 2018 report from the Arizona Board of Regents.

The median loan debt of the Arizona class of 2012 rested at $19,883 in 2017 while the national average debt was $24,477 according to the report.

The Institute for College Access & Success, a nonprofit dedicated to making post-secondary education more affordable, found in 2016 that Arizona is the fourth lowest student debt state after Utah, New Mexico and California at first, second and third respectively.

All of the loan data collected in the report falls under two categories: non-federal/private loans and federal loans.

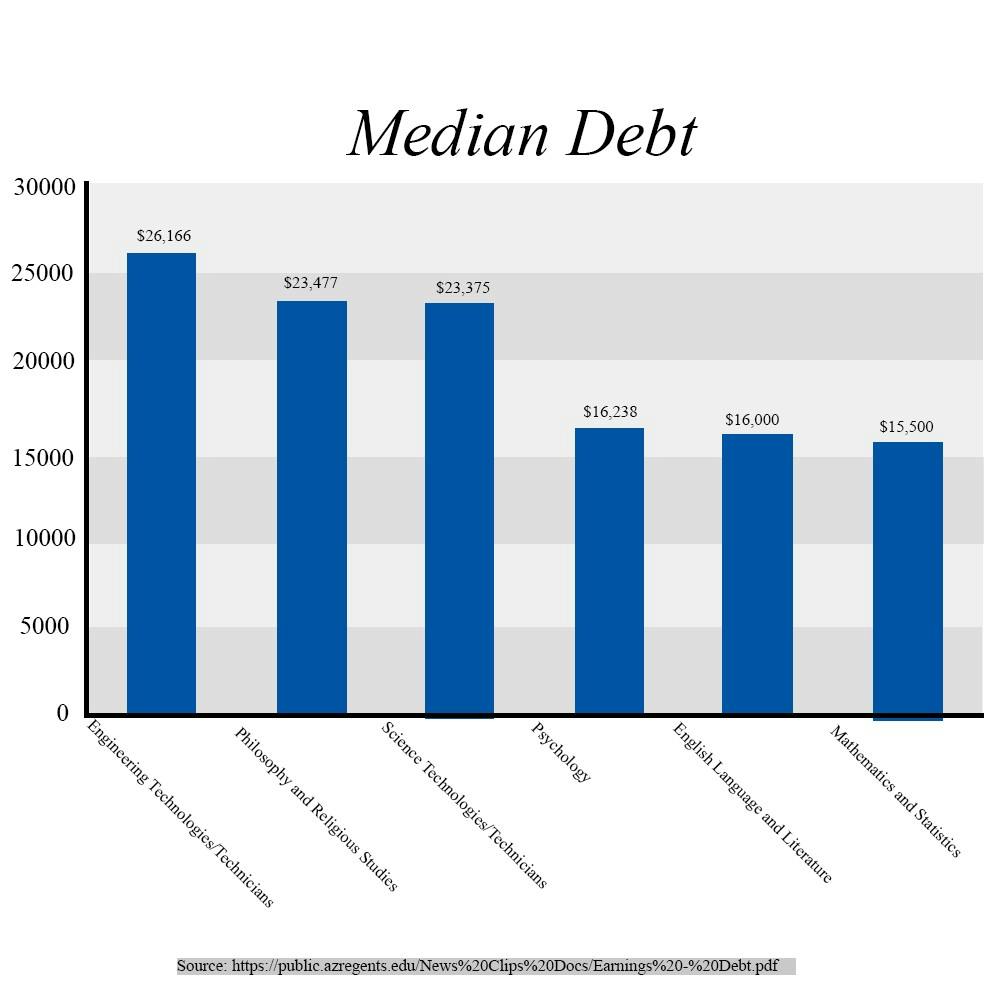

However, there is a disparity of median debt among different majors at ASU, with engineering technology/technician graduates having the highest debt and mathematics and statistics graduates having the lowest.

Melissa Pizzo, assistant vice president of enrollment services, said that for the next couple of years ASU will focus on keeping tuition as low as possible.

“(ASU President Michael Crow) has made a ten-year commitment to Arizona residents that tuition increases would not be more than 3 percent in any given year,” Pizzo said.

Even though Arizona has relatively low average student debt, 49 percent of Arizona undergraduates still have accumulated debt after they graduate.

John Arnold, the executive director of ABOR, is in charge of the board’s strategic plan for advancing higher education. He said that lowering both the number of people with debt and the amount of debt are prasieworthy goals and that ABOR is looking at several strategies to reduce debt.

“We look at ... our four year graduation rates ... keeping tuition as low as possible ... and finally (having) a robust financial aid program," Arnold said.

Like Pizzo, Arnold also commended ASU for its efforts to keep tuition as affordable as possible, highlighting Crow’s commitment to limited tuition increases.

Despite the difficulties many students experience with student loans, some say their loans are manageable and a necessary expense.

“Personally, I’d say (student loans) impacted (me) positively because I personally have an investment in my education,” Cody Thornburg, a senior studying civil engineering, said.

Reach the reporter at mzhao49@asu.edu and follow @michelle_zhao23 on Twitter.

Like The State Press on Facebook and follow @statepress on Twitter.