State Senator from Legislative District 26 Juan Mendez cannot afford a house in his own district, and he is not alone.

Millennials, or those born between 1981 and 1996, have lived through the worst economic downturn the U.S. has faced since the Great Depression and are now graduating from college with suffocating student debt.

“A large portion of the millennial generation basically haven't had the chance to build up good economic status — some of them because of their debt burden and because of the disadvantaged job market that they faced," Deirdre Pfeiffer, associate professor at ASU’s School of Geographical Sciences and Urban Planning, said.

Although students from Arizona typically have a lower average debt compared to national averages, they still graduate with around $20,000 in debt.

Read more: ABOR: Arizona graduates hold less debt than national average

When Mendez, an ASU alum, chose to find a home in Tempe, a city within the district he represents as a state senator, he found he was priced out of the housing market.

The average price of a home in Tempe is $281,900 and the average price to rent is $1,550 per month, according to Zillow Research, an online real estate and rental database.

“I have never even been able to afford rent on my own. I have always lived with a roommate or with my partner,” he said. “Every time I tried to buy a house, I got priced out.”

Mendez's legislature salary is $24,000 a year and he said he earns $3,000 working as a substitute teacher at Tempe Union High School District and co-instructor at Phoenix College.

“I talked to a lot of voters who say they’re afraid that their kids are not going to be able to live in Tempe with just how crazy the prices are,” he said.

However, this may not solely result from high housing prices, but also because of where millennials choose to live.

“There's a portion of millennials that want to live in more dynamic, amenity-rich areas, in walkable communities near transit,” Pfeiffer said. “In the Phoenix region, there are a lot more opportunities to buy a home out in the more suburban areas, which people in that millennial generation are not really looking for and so they're choosing to rent in the urban areas rather than buy.”

This desire to live closer to amenities and civic centers has created a roadblock for those wanting to buy houses near those areas.

As a senator, Mendez is working on solutions in the Capitol to help break down this roadblock.

He is working with the non-profit Newtown Community Development Corp., a community land trust that collects houses and sells them at affordable prices to first-time homebuyers who would otherwise be priced out of the market.

However, Mendez said the property taxes for the homes in these programs should be reduced.

“What I’m working on today is to totally reimagine and recreate permanent, affordable housing inside the housing stock that we already have,” he said.

Mendez has been working on a bill to cut property taxes for those who are in community land trust programs like Newtown. The bill has not yet progressed to a vote.

“We had a lot of people at the table last year talking about how to change the bill to make it more specific to increase the possibilities of getting it passed,”Allen Carlson, executive director of Newtown Community Development Corp, said.

Mendez said the bill's goal is to have the state help homebuyers in these programs.

“The people who usually take advantage of these community land trust programs just don't have the funds to pay the same property taxes that their neighbors pay,” Mendez said. “I want people to be graded on a scale, the same way we tax seniors, so they have lower property taxes through my bill.”

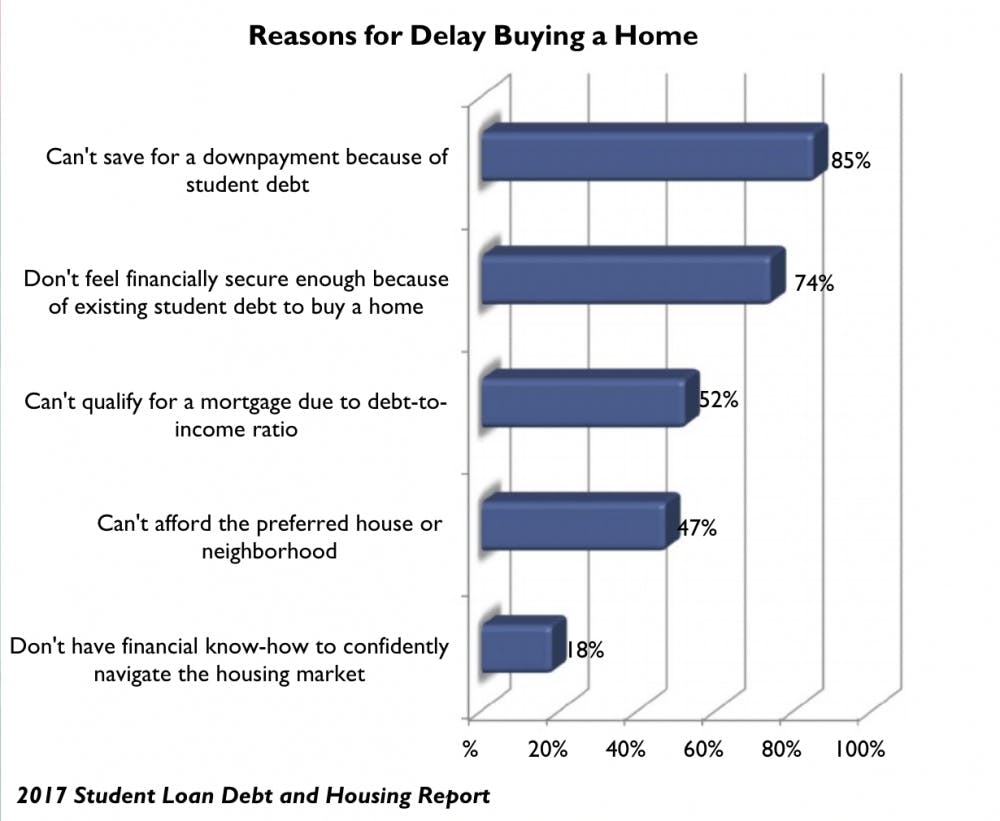

Carlson said one of the crucial limiting factors for millennial homebuyers is student debt.

“As an agency we see a lot of people who want to buy a house, but they have really large student loans and that limits how much they can borrow, which then prevents people from buying a house,” Carlson. “We are basically helping provide housing affordability assistance.”

Programs like community land trusts are little-known to students and millennial homebuyers. However, Pfeiffer said students should be taking advantage of these programs.

“It's something that I would guess most millennials don't even know what that is,” she said. “I think it is a model though that could be attractive to them given their unique challenges that they face entering the more traditional housing market, using conventional loans and things like that. But obviously there's a lot of work to do in terms of telling the story about what these are.”

Reach the reporter at mlshuman@asu.edu or follow @mackenzieshuman on Twitter.

Like The State Press on Facebook and follow @statepress on Twitter.