Hunched over, Thomas Fagan pauses after a dropped call on his cell phone. He looks at his phone for a moment before dialing again, and soon continues his conversation.

"I was scared, I thought maybe I went over my credit card limit for this month and my phone bill didn't go through," Fagan says.

At close to $5,000 in credit card debt, the Palo Verde Community College sophomore is not alone. Each year, more college students join the multitudes who live in debt and find it nearly impossibly to catch up with the bills.

Chris Tulipana, assistant vice president of the Bank of America on Mill Avenue, says a lot of ASU students apply to his bank each year for credit cards, and most of them are approved.

"Students can get a low-limit credit card in their name from our bank having zero credit," she says. "We usually give freshmen a limit of about $500, but we may move it up to $700 if they are older, perhaps a graduate student."

But the ultimate goal of banks is to teach the importance of positive money management skills, Tulipana says.

"We get a lot of beginners, and we try to teach them how to keep good credit," Tulipana says. "Our goal is to help them avoid getting into debt."

However, students with a less than stellar record don't get the same offers as other students.

"We turn away a lot of students who have already ruined their credit, because they haven't shown that they can handle a credit card," Tulipana says.

At only 17 years old, political science freshman David Kitchen has already tainted his credit history.

Kitchen is about $8,000 in debt, with just $600 in his bank account.

He got his first credit card in a friend's name when he was 16 with a limit of $1,000. Currently, Kitchen has three cards under his name, and each one is sufficiently maxed out.

"I make $1,300 each month from my job at Starbucks, but I can only afford to pay the minimum monthly amount, so the interest adds up," he says.

"I really shouldn't be in debt, since I have a scholarship that pays for my tuition, dorm fees and books, and I don't have any student loans," Kitchen says. "But I'm a big spender. I just like to buy things, and I go to P.F. Chang's about three times a week."

Kitchen says most of his purchases that led to his debt were spring break trips, cell phone and hospital bills and traffic tickets.

But, he spent $4,000 of his overall debt on a recent trip to San Diego.

"We spent four nights in a nice hotel, went shopping at the malls there, and I also bought a new laptop," he says.

In the future, Kitchen plans to take out loans to consolidate his debts into one payment.

"I'm going to use student loans for my debts because I don't need them to pay for school," he says.

As for his advice for students who don't have credit cards, Kitchen says that's for the best.

"I would recommend that students use credit cards simply as a means to build their credit," he says. "Only buy what you know you can pay for, and just use it for necessities.

"Most college students don't know how to spend money wisely, and credit card companies target us because they know we will turn a profit for them," he adds.

Fagan's situation is similar to Kitchen's.

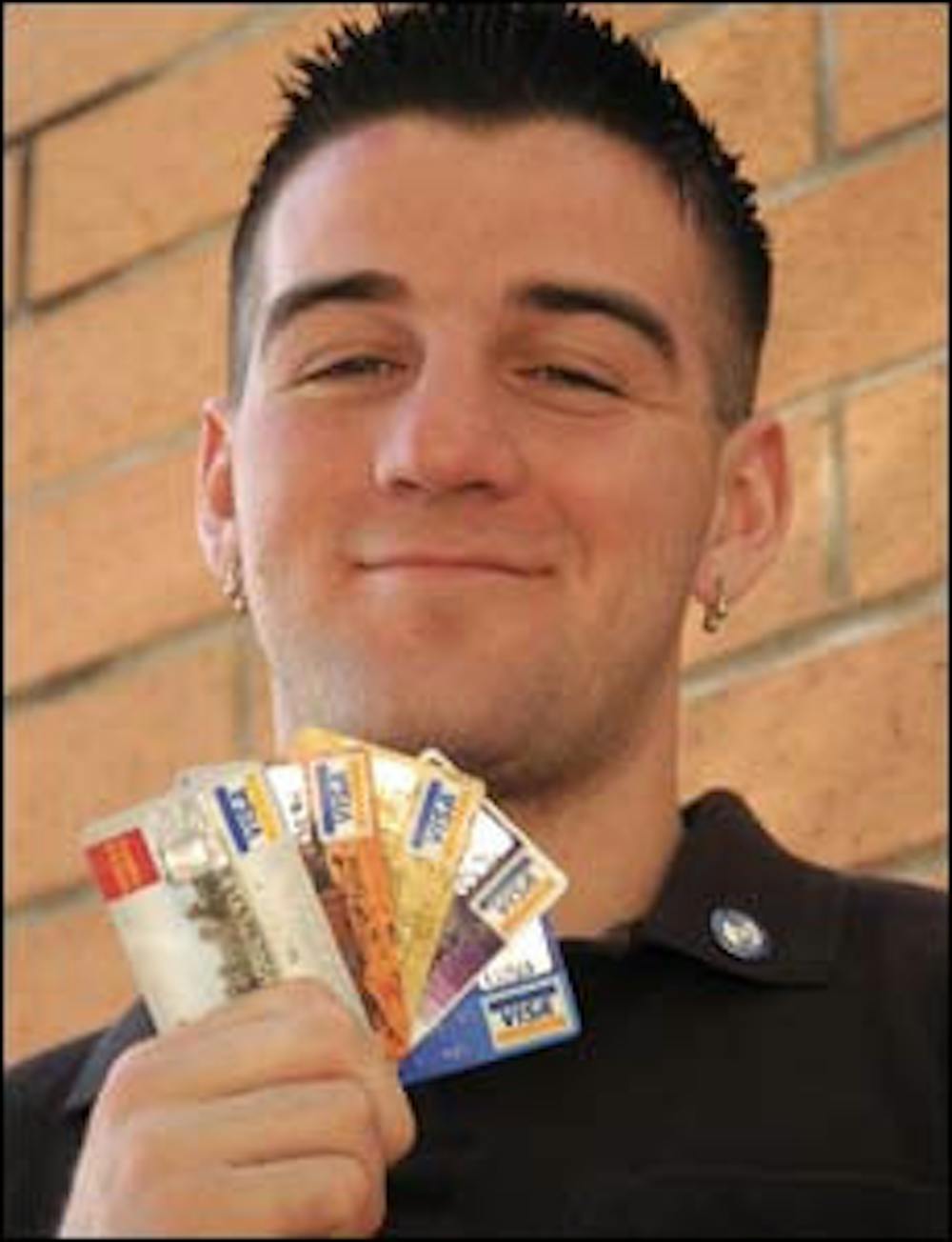

He has four accounts right now, with his highest limit at $4,000. However, Fagan says that he only has about $600 available collectively on all of his cards.

"They're pretty much filled to the brim," he says.

He says his second credit card is what really plunged him into debt. He used it to buy a car, and now, he is between $4,000 and $5,000 over his head

However, Fagan remains optimistic.

"I actually think I have pretty good credit besides my debts, because I am always on time with my payments."

When applying for a credit card, Fagan says it is fairly easy to get a higher limit from a company.

"They ask for your household income, so technically that includes everyone you live with," he says. "The reason I got a limit of $4,000 is because I included my parents' income on the application."

Fagan says it's easy to rack up debt with the illusion of excess cash that credit cards create.

"It doesn't seem real," Fagan says. "Three digits doesn't seem like much anymore, and then four digits isn't shocking anymore, and it just keeps on going."

He adds that when his family gave him money for tuition, he would charge it to his card and then keep the cash.

Fagan also advises students against getting in over their heads.

"If anything, I would tell college students to get a small limit, maybe between $200 and $500 and only use it for necessary items like gas and food. Otherwise, they'll just keep on spending like it's nothing."

Someday, Fagan plans on consolidating his debts, much like Kitchen.

"I'm going to get a student loan that puts all of my debts together and worry about it when I'm through with college," he says.

Reach the reporter at kate.kliner@asu.edu.