Podcast Desk Reporter Balin Overstolz-McNair sits down with Mark Stapp, Executive Director of Real Estate Programs at ASU. They discuss the real estate market in the Phoenix Metropolitan Area. Stapp provides insight on the background and origins of Phoenix's real estate market, some of the challenges the city faces today, how students may be effected, ASU's role in development and what Phoenix may look like in the future.

Balin Overstolz-McNair: As of 2018, the Phoenix metropolitan area saw a 7.4 percent increase in rent prices, tying with Las Vegas for the largest rent increase in the United States. Rising rent prices are occurring in areas of the city that are being further developed, which also happen to be hubs of student life such as downtown Phoenix and Tempe. Rising rent means more than simply paying more month to month. On one hand, it can stimulate a growing economy, on the other hand, it can push Phoenix residents into lower quality homes or even result in homelessness for those who can not afford to keep up. In order to learn more about this issue, we reached out to the W.P. Carey School of Business here at ASU.

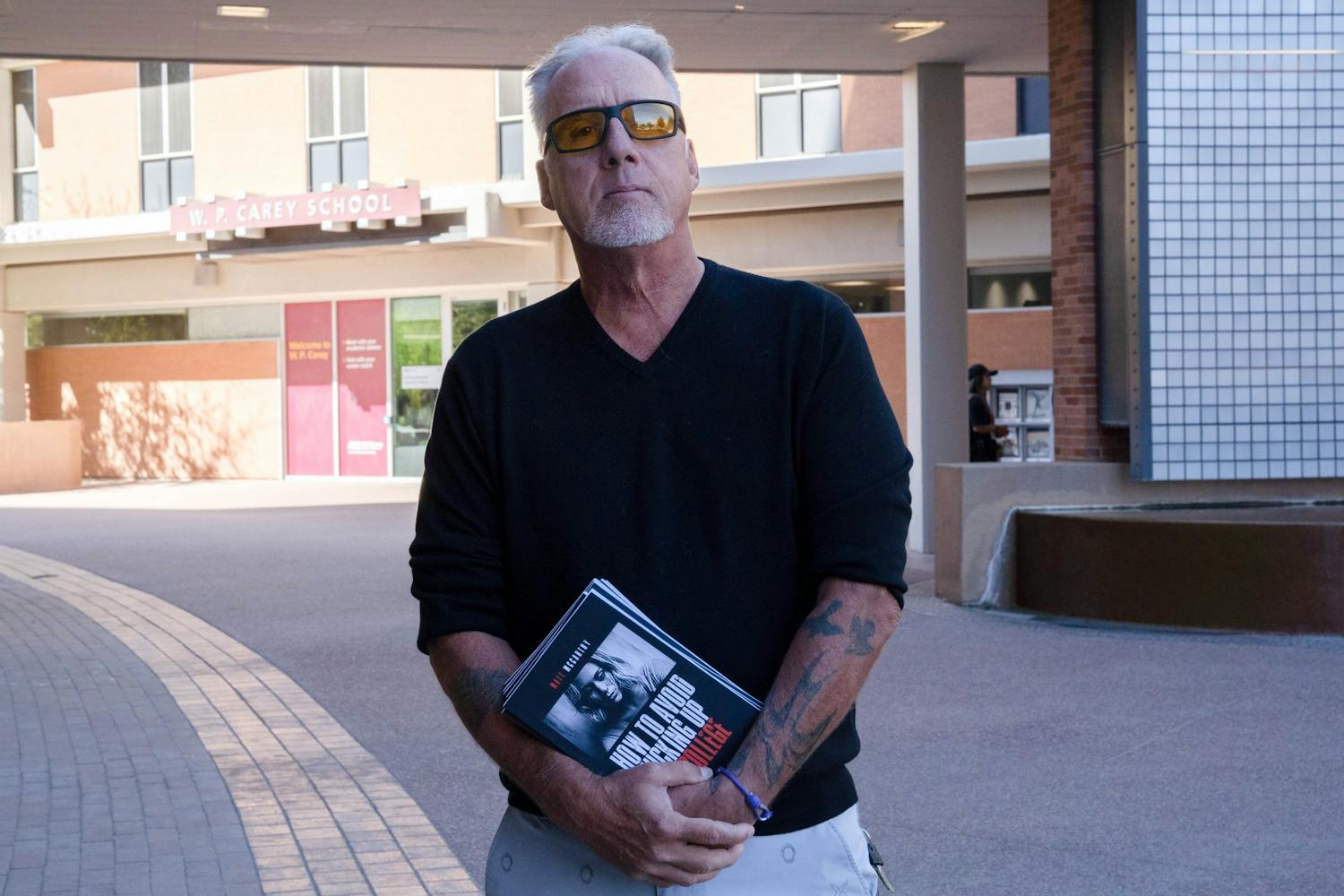

Mark Stapp: I'm Mark Stapp. I'm the Fred E. Taylor Professor of Real Estate and the Executive Director of real estate programs at W.P. Carey School of Business.

Balin Overstolz-McNair: Before we discuss the current market of Phoenix, could you explain how Phoenix real estate was formed and what growth has looked like traditionally?

Mark Stapp: The Phoenix metro area is a very young metropolitan area, and it really became a significant growth area after World War 2 and, in particular, in the 50s with the advent of the automobile and air conditioning. Those were two predominant drivers, but the growth was the result of a military infrastructure that was developed during first during World War I to some degree and then during World War II in particular. You had a number of military facilities, Luke Air Force Base and Williams Air Force Base, and so you had companies developing here because of its relationship with those military installations. We started developing a significant industrial base because of that, but we also had other industries that were growing at the time. That set us on this significant growth path. The greatest percentage growth occurred for metropolitan Phoenix at the beginning of the 60s on a pure percentage basis.

Balin Overstolz-McNair: Now moving more recently into that rent increase we saw in 2018, why is this happening and what could it potentially mean for the city?

Mark Stapp: The reason is basic economics, and that has to do with significant demand, coupled with increasing costs. Phoenix is growing between 1.8 and 2 percent a year. We're adding somewhere around 100,000 people per year to this marketplace. That creates the demand. Coupled with that demand is a need to add those units. Development has to occur to build the units to accommodate this growth. One of the issues that we've had over the last several years is the cost of creating those units has gone up. It's gone up because material price increases and because of labor shortages which has made both the time to construct something longer and the cost to provide the labor higher. The other thing that happened is that land prices have also increased. You take those three factors – land and labor with material cost increases and you have the formula for higher costs. In order to warrant spending the money to build the units you have to charge enough rent. That's what's been happening.

The way that hurts the market is to put downward pressure on the market because you can't provide enough supply. If you can't have enough supply that means people that want to move here can't because there's no place for them to live. That causes prices to go up, exacerbating the problem. That's bad for economic development because employers want to be someplace where they can find the greatest talent that's the most effective and if the talent can't move here, then they can't attract the employees they need to successfully run their business, and they won't want to be here.

Balin Overstolz-McNair: As far as real estate that is ideal for students goes, what can we expect to see in the future?

Mark Stapp: As more units are added to the market place and they're higher end units – the kind of development that's occurring around here is more urban style so the type of construction is different and it's much more expensive. Mid-rise, high-rise development is costlier than suburban style development. As a consequence, again, you're getting more density but you're getting more expense.

It's not going to be easy to provide affordable housing in and around the campus area. That's an issue for students because they need someplace to live. They need to be close to campus, and it's going to be increasingly difficult. I don't think that that's going to change. I think you'll find the same thing not only in Tempe but in the downtown campus as well. The downtown market is a little bit different because I believe there's considerably more available land for adding new units. You're going to begin to see I think some of a lot of that housing pushing west of Central Avenue where is most of the development until the last couple of years has all been east of Central Avenue. Now, you're beginning to see a push in a significant way westward.

I think ASU's role in this is is securing the land for that kind of development to occur. The University recognizes this is a critical issue for students and is seeking ways to increase the amount of space available for students that can afford to live there. ASU is probably one of the most significant economic drivers in our metropolitan area, in the state in general, but in the metropolitan area. Especially given the very forward looking and aggressive expansion that has occurred in the University. It's attracting research dollars and researchers and faculty that are considerably higher level than they were before 2000.

Balin Overstolz-McNair: With the city moving in a direction that could be potentially less suitable for lower-income residents and students, how might we see quality of life improve in other ways?

Mark Stapp: I think because we're so young, we don't have the social infrastructure that creates barriers in these social constructs that make it harder for people to get into our economic system. It's also because of the ease with which we can expand. The combination of those things make it easy for us, and because we're so young, we're just beginning to see what we might look like as a fully mature metropolitan area in its multi-nodal urban form. It's not the old industrial single downtown CBD [Central Business District] where growth occurred in concentric rings out from there. I think more than a lot of what people normally talk about is understanding our need to increase community capital and in particular make this a place for healthy living, because sustainability and resiliency ultimately relates to the overall health of a population. We don't focus on that as a place. I think that's a real opportunity for us. It's an opportunity to create that resilient place we talked about, but it's also a differentiator for us from a competitive standpoint.

Balin Overstolz-McNair: For The State Press, I am Balin Overstolz-McNair.

Reach the reporter at Boversto@asu.edu and on Twitter @boversto_asu.

Like State Press on Facebook and follow @statepress on Twitter